43 w4 form 2022

PDF 2022 Form W-4R - irs.gov Form W-4R 2022 Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions Department of the Treasury Internal Revenue Service Give Form W-4R to the payer of your retirement payments. OMB No. 1545-0074. 1a . First name and middle initial. Last name Address . City or town, state, and ZIP code. 1b Social security number ct w-4 form 2022 | 2022 W4 Form W 4 2022 Form. Manuel S. King March 23, 2022 2022 W4 Form No Comments. W 4 2022 Form - 2022 W4 Form - Employee's Withholding Certificate, or more commonly known as Form W-4 is the tax form employees need to provide their employers ….

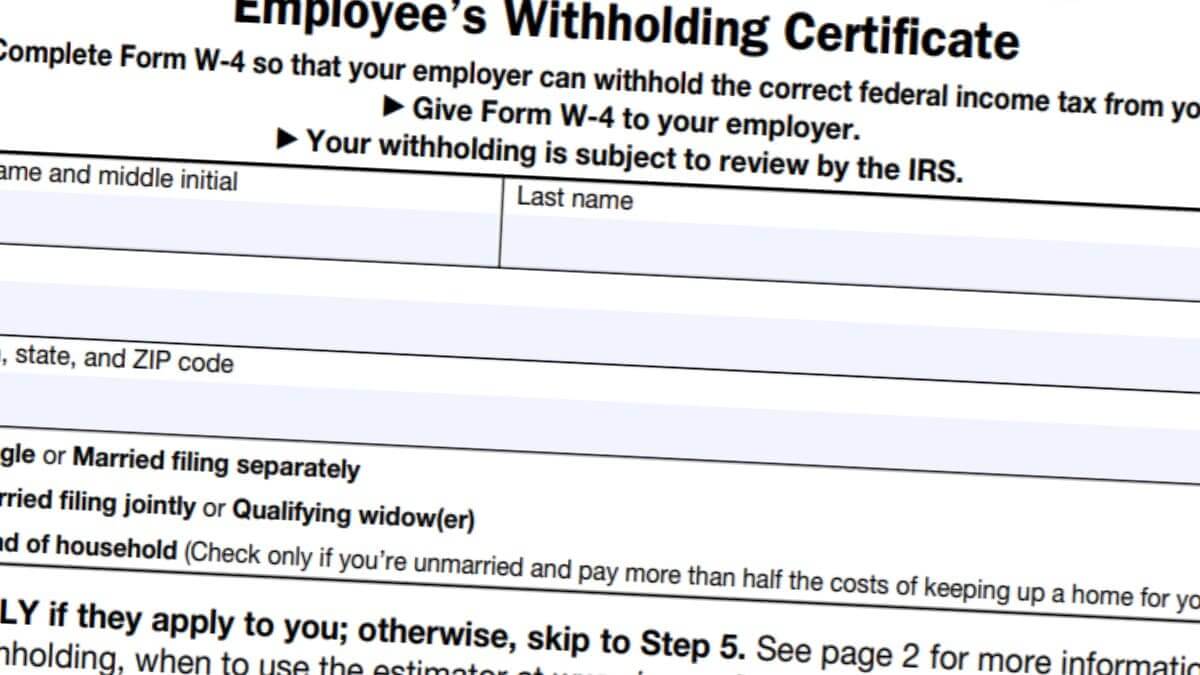

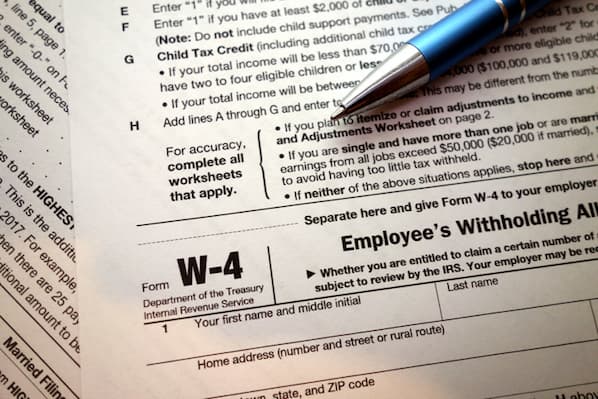

2022 W-4 Tax Form - 2022 W4 Form 2022 W-4 Tax Form - 2022 W4 Form - The W4 form is a document used for tax reporting purposes issued by the Internal Revenue Service (IRS). The document is known as the "Employee's Withholding Certificate". It informs employees about how much tax they need to withhold from each paycheck.

W4 form 2022

› pub › irs-prior2022 Form W-4P Form W-4P 2022 Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Give Form W-4P to the payer of your pension or annuity payments. OMB No. 1545-0074 Step 1: Enter Personal Information (a) First name and middle initialLast name Address City or town, state, and ZIP code › pub › irs-pdf2022 Form W-4 - IRS tax forms 2022 Form W-4 Form W-4 Department of the Treasury Internal Revenue Service Employee’s Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1: W-4 Form 2022 Printable - 2022 W4 Form 18.01.2022 · W-4 Form 2022 Printable - 2022 W4 Form - The W4 form is paper utilized for tax reporting purposes issued by the Internal Revenue Service (IRS). The document is formatted with a name of 'Employee's withholding Certificate which explains the amount of tax which employers have to withhold from the employees' each pay check. This

W4 form 2022. › w-4-tax-withholding-form-forW-4 2022 Tax Withholding Form for Employees - W-4 Forms - TaxUni Mar 22, 2022 · Learn more about how to file Form W-4 in 2022 here. Fill out Form W-4 online You can fill out Form W-4 online through our PDF editor. It’s an effective method to file Form W-4, especially if you’re anticipating to e-mail the document to your employer. Additionally, you can print out a paper copy with the information you entered on the form. W-4 Form 2022 - Fill out PDF The W-4 will show you all the information in one document that the IRS knows. W-4 Forms for 2022 IRS W-4 Forms for 2022 What will my W-4 Form say? The W-4 will be completed by completing the following questions: "Do you work for an employer? (Employer is the Federal government only) "If Yes, please explain…" About Form W-4, Employee's Withholding Certificate ... Information about Form W-4, Employee's Withholding Certificate, including recent updates, related forms and instructions on how to file. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. w - 4 form 2022 | 2022 W4 Form W-4 Form 2022. Manuel S. King March 6, 2022 2022 W4 Form No Comments. W-4 Form 2022 - 2022 W4 Form - The Employee's Withholding Certificate, also more commonly known as Form W-4 is the tax form employees use to let their employers ….

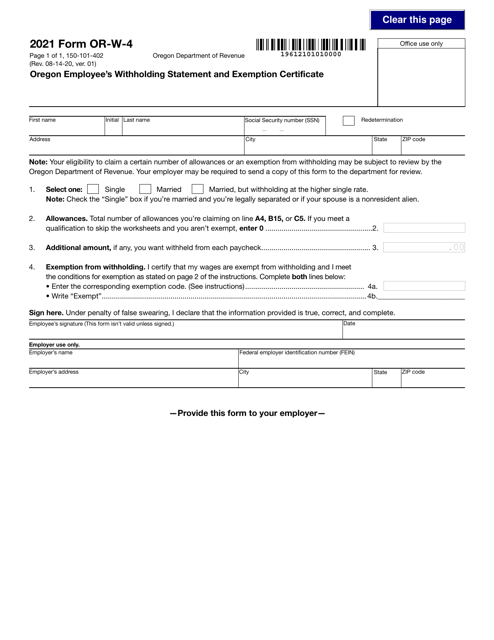

PDF 2022 Form OR-W-4, Oregon withholding Instructions, 150-101 ... 2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1 1511421 ev 11321 1 of 7222 o 4 o Purpose of this form Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. How to Fill Out a W4: 2022 W4 Guide - Gusto Taxpayers who fill out the 2022 W-4 form are less likely to wind up with a large tax bill or a giant refund when they file tax returns in 2023—money that could have been invested or spent on essential expenses throughout the year. PDF 2022 Form W-4 - lakeshorefarmmanagement.com Title: 2022 Form W-4 Author: tinas Created Date: 1/25/2022 3:19:17 PM Department of Revenue Services State of Connecticut Form ... Form CT-W4 Employee's Withholding Certificate Department of Revenue Services State of Connecticut (Rev. 12/21) Effective January1, 2022 Employee Instructions • Read the instructions on Page •2 before completing this form. •Select the filing status you expect to report on your Connecticut income tax return. See instructions.

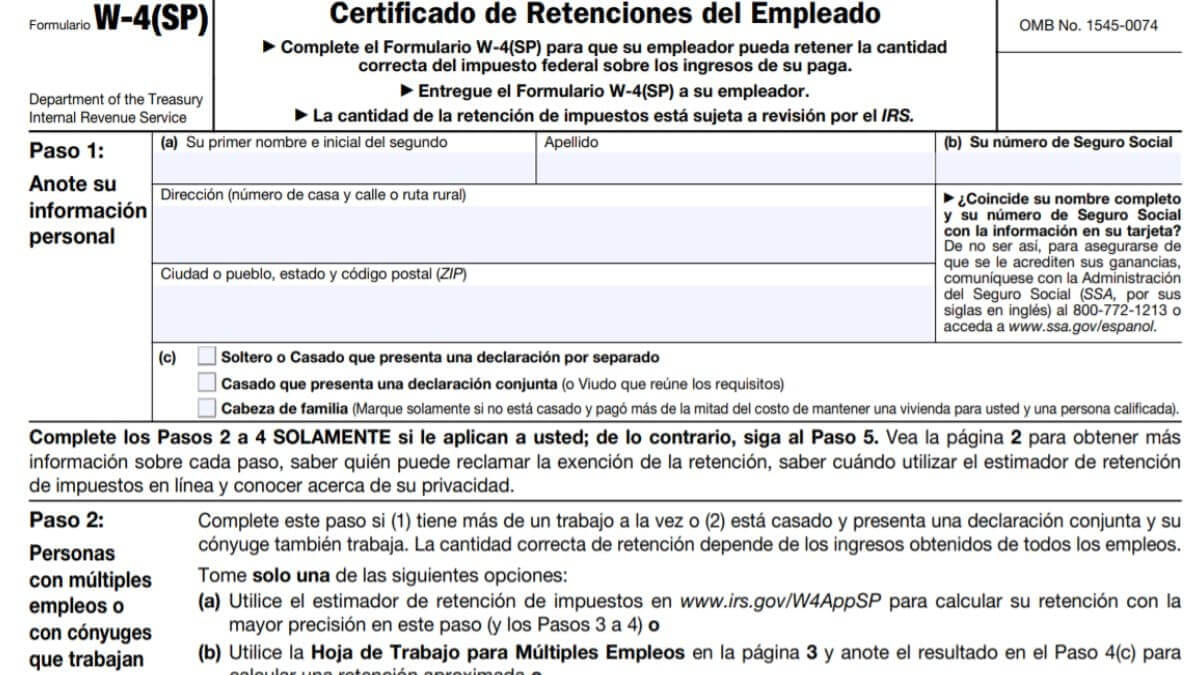

Forms and Publications (PDF) - IRS tax forms 2022 12/30/2021 Form W-4 (sp) Employee's Withholding Certificate (Spanish version) 2022 01/12/2022 Form W-4P: Withholding Certificate for Pension or Annuity Payments 2022 01/31/2022 Form W-4R: Withholding Certificate for Retirement Payments Other Than Pensions or Annuities Michigan Form MI-W4 (Employee's Michigan Withholding ... Reset Form MI-W4 (Rev. 12-20) EMPLOYEE’S MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE STATE OF MICHIGAN - DEPARTMENT OF TREASURY This certificate is for Michigan income tax withholding purposes only. Read instructions on page 2 before completing this form. 41. Full Social Security Number Issued under P.A. 281 of 1967. 4. Driver’s License … PDF 2022 IA W-4 Employee Withholding Allowance Certificate 2022 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov 44-019a (10/14/2021) Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W -4 at any time if the number of your allowances increases. Forms and Publications (PDF) - IRS tax forms Form W-4S. Request for Federal Income Tax Withholding from Sick Pay. 2022. 12/22/2021. Form W-4R. Withholding Certificate for Retirement Payments Other Than Pensions or Annuities. 2022. 01/03/2022. Form W-4P.

2022 W4 Form Printable, Fillable Online and How to Fill It? The 2022 W4 Form is a paper used for tax reporting purposes issued by the Internal Revenue Service (IRS). This document has a format title of ‘Employee’s Withholding Certificate’ and it informs about the amount of tax to withhold from the employees’ every single paycheck. The employers use this form to calculate and report certain taxable income to the IRS on behalf of …

PDF IA W-4 (44109) - tax.iowa.gov 2022 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov 44-019a (10/14/2021) Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W -4 at any time if the number of your allowances increases.

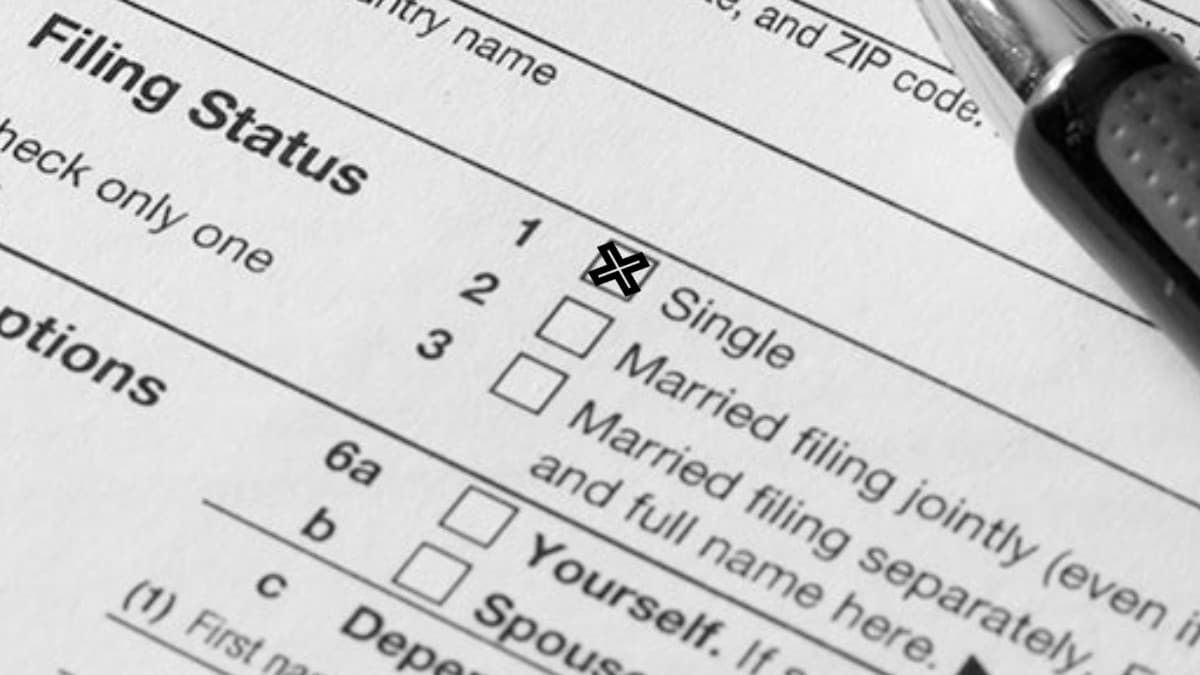

W4 Form Example For Single 2022 - W-4 Forms - Zrivo 19.12.2020 · W4 Form Example for Single 2022. Michelle Adams Last Updated: December 19, 2020. 0 2 minutes read. Contents. 1 Form W4 Part 1; 2 Form W4 Part 2 and Part 3 for Single Filers; 3 Form W4 Part 4 and Part 5 for Single Filers; Form W-4 is a tax form that employees fill out to adjust how much tax needs to be withheld from their income. Form W4 example for …

W4 Spanish Instructions 2021 - 2022 - W-4 Forms - Zrivo 17.02.2022 · Home/IRS/IRS Forms/W-4 Forms/ W4 Spanish Instructions 2021 - 2022. W-4 Forms W4 Spanish Instructions 2021 - 2022. Michelle Adams Last Updated: February 17, 2022. 0 1 minute read. The Internal Revenue Service has the Spanish version of Form W-4. This version of Form W-4 used to be only for employees in certain US territories, like Puerto Rico. According …

W4 Form 2022 - W-4 Forms - TaxUni 29.01.2022 · Get W4 Form 2022 Every worker in the United States should file Form W4 accurately so that the taxes withheld from their income throughout the tax year is appropriate with their tax liability. If too much or less tax is withheld from the wages every pay period, the outcome of this won’t be feasible.

PDF W-4MN, Minnesota Employee Withholding Allowance/Exemption ... Federal Form W-4 will not determine withholding allowances used to determine the amount of Minnesota withholding. Employees completing a 2022 Form W-4 will need to complete 2022 Form W-4MN to determine the appropriate amount of Minnesota withholding. Lock-In Letters

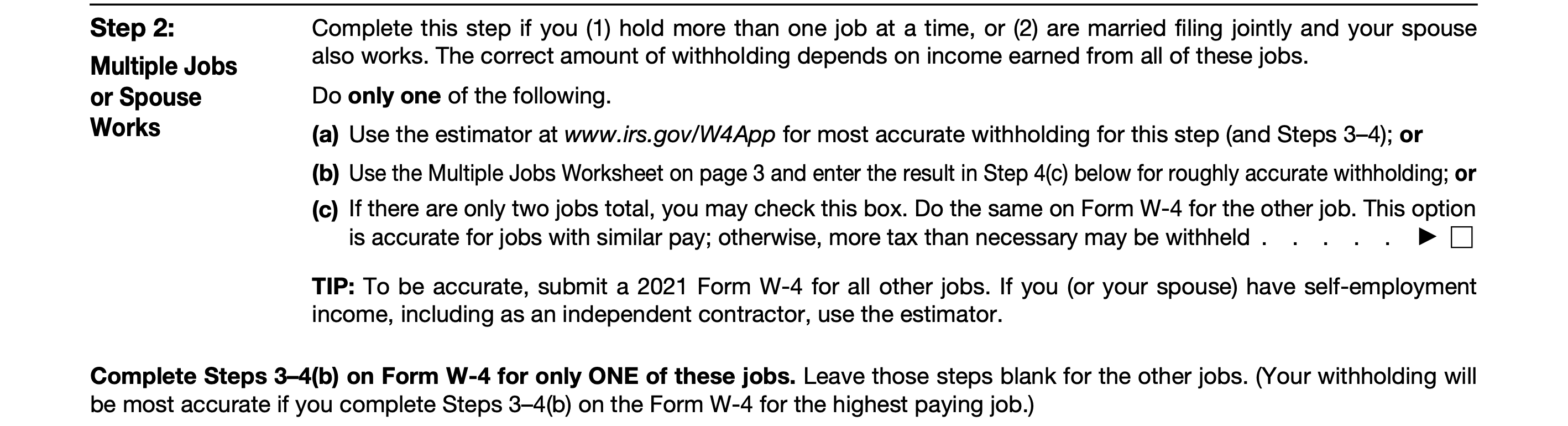

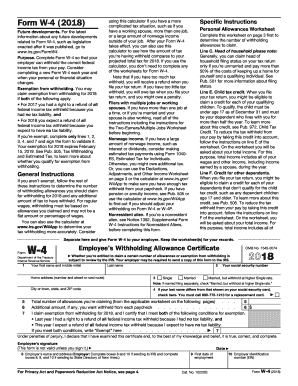

2022 New Federal W-4 Form | No Allowances, Plus ... This new Form W-4 is divided into five steps: Enter Personal Information Multiple Jobs or Spouse Works Claim Dependents Other Adjustments Sign Here The IRS only requires that employees complete Steps 1 and 5. Steps 2 - 4 are reserved for applicable employees.

SOUTH CAROLINA EMPLOYEE'S WITHHOLDING ALLOWANCE ... Your employer may be required to send a copy of this form to the SCDOR. 1 . First name and middle initial. Last nameAddress City State ZIP . Single. 2. Social Security Number. 3. Married. Married, but withhold at higher Single rate. If Married filing separately, check . Married, but withhold at higher Single rate. 4. Check if . your last name is different . on your Social Security …

PDF Form MAINE W-4ME Employee's Withholding Allowance Certificate The employer/payer is required to submit a copy of federal Form W-4 to the Internal Revenue Service either by written notice or by published guidance as required by federal regulation 26 CFR 31.3402(f)(2)-1(g); or B. An employee performing personal services in Maine furnishes a Form W-4ME to the employer containing a non-Maine address and, for ...

co.uintah.ut.us › 2022 W42022 Form W-4 2022 Form W-4 Form W-4 Department of the Treasury Internal Revenue Service Employee’s Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1:

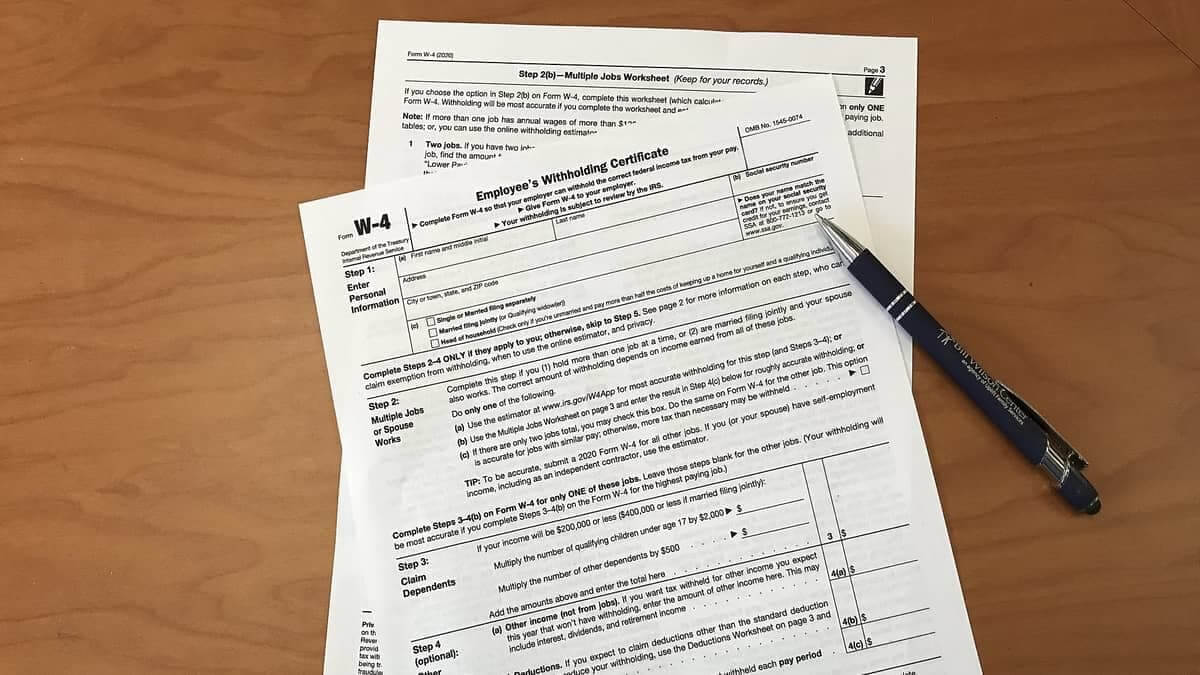

› how-to-fill-out-form-w4-guideHow to Fill Out a W-4 Form in 2022: Guide and FAQs - NerdWallet Once completed, give the signed form to your employer's human resources or payroll team. Page 1 Form W-4 (2022) What should I put on my W-4? If you got a huge tax bill when you filed your tax...

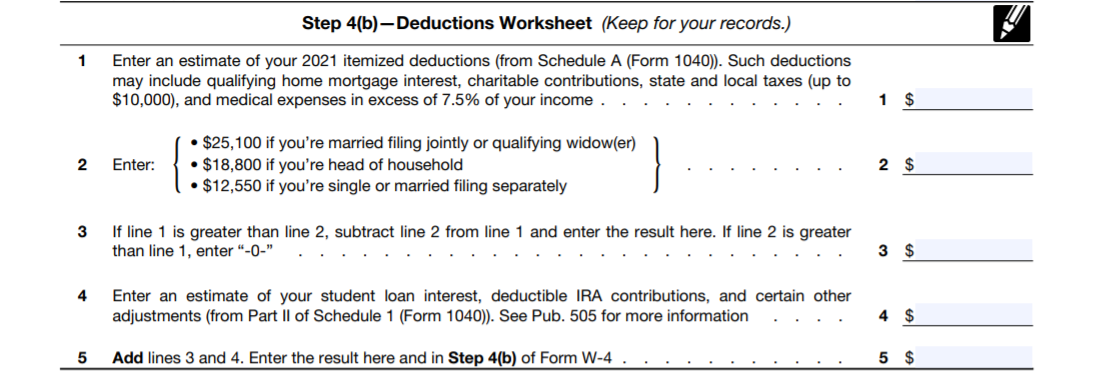

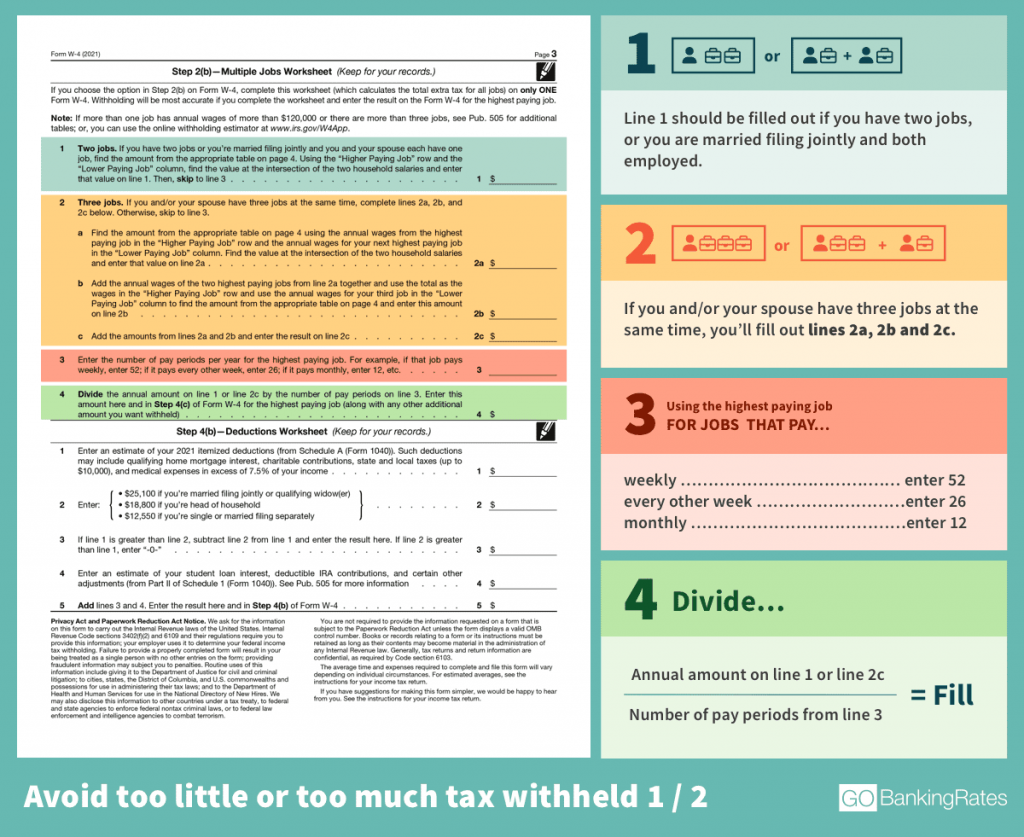

PDF 2022 Form W-4 - marylandtaxes.gov Form W-4 (2022) Page 3 If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

› articles › personal-financeW-4 Form: How to Fill It Out in 2022 - Investopedia Feb 08, 2022 · 2022 Form W-4 Married Filing Jointly Income Tax Table. If you have three or more jobs combined between yourself and your spouse, then you will need to fill out the second part of the Multiple Jobs...

PDF Oregon Withholding Statement and Exemption Certificate 2022 Form OR-W-4 Oregon Withholding Statement and Exemption Certificate Office use only Page 1 of 1, 150-101-402 (Rev. 09-30-21, ver. 01) Employer's name Employee's signature (This form isn't valid unless signed.)

How To Fill Out a W-4 Form or W4 Tax Withholding, 2022 How to fill out a W-4, W4 in 2022? Tax Withholding Is an Important Part of Your Tax Return. Fill Out the W-4 Form Now and Prep for 2022, 2023

irs form w-4 2022 | 2022 W4 Form Form W-4 2022 - 2022 W4 Form - The employee's withholding certificate, commonly called Form W-4 is a tax-related form that employees use to inform their employers about their …

W-4 Form 2022 Printable - 2022 W4 Form 18.01.2022 · W-4 Form 2022 Printable - 2022 W4 Form - The W4 form is paper utilized for tax reporting purposes issued by the Internal Revenue Service (IRS). The document is formatted with a name of 'Employee's withholding Certificate which explains the amount of tax which employers have to withhold from the employees' each pay check. This

› pub › irs-pdf2022 Form W-4 - IRS tax forms 2022 Form W-4 Form W-4 Department of the Treasury Internal Revenue Service Employee’s Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1:

› pub › irs-prior2022 Form W-4P Form W-4P 2022 Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Give Form W-4P to the payer of your pension or annuity payments. OMB No. 1545-0074 Step 1: Enter Personal Information (a) First name and middle initialLast name Address City or town, state, and ZIP code

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.11.56PM-f1acacbff47b48a183ac6e2538e1f774.png)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

0 Response to "43 w4 form 2022"

Post a Comment