40 defined contribution pension plan definition

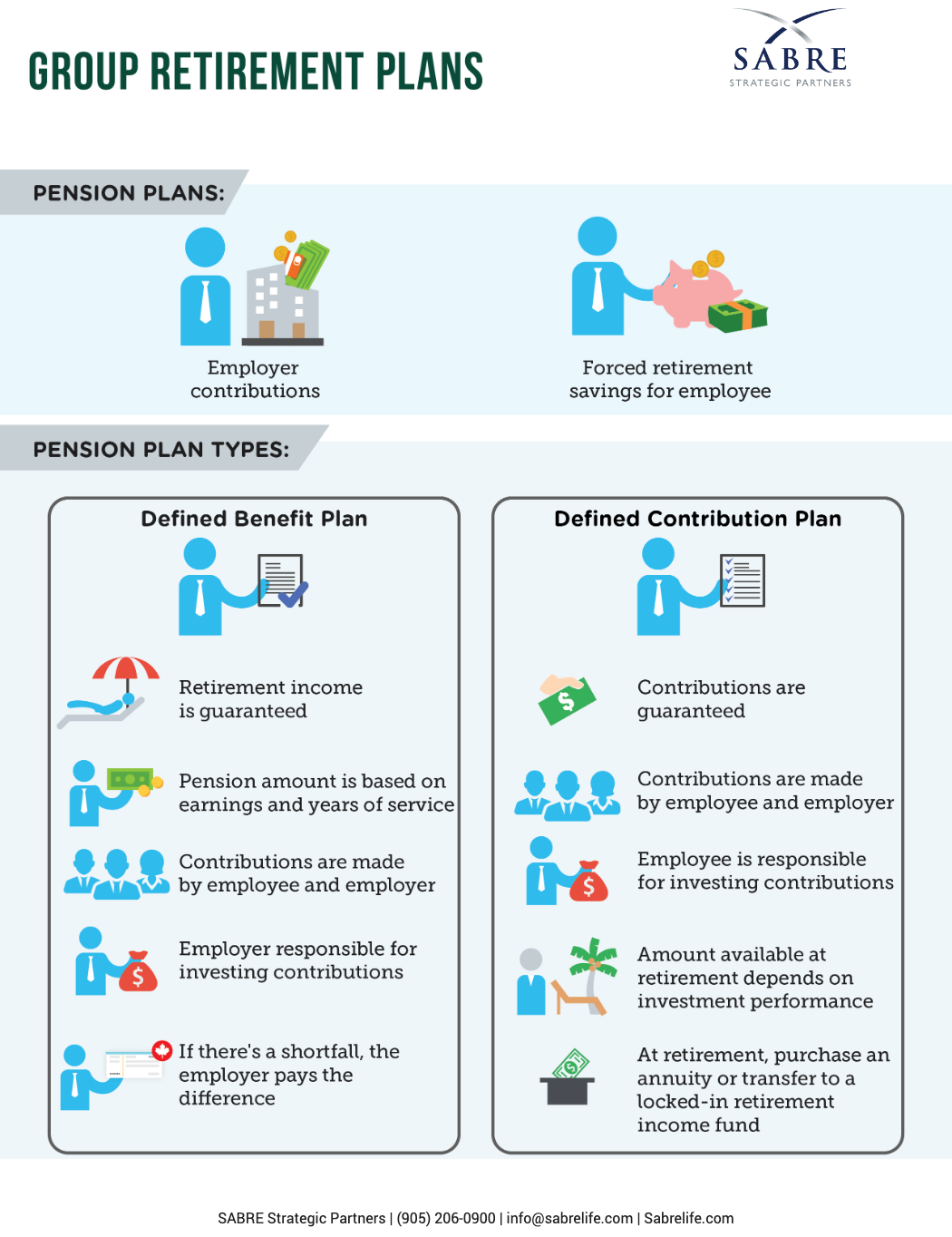

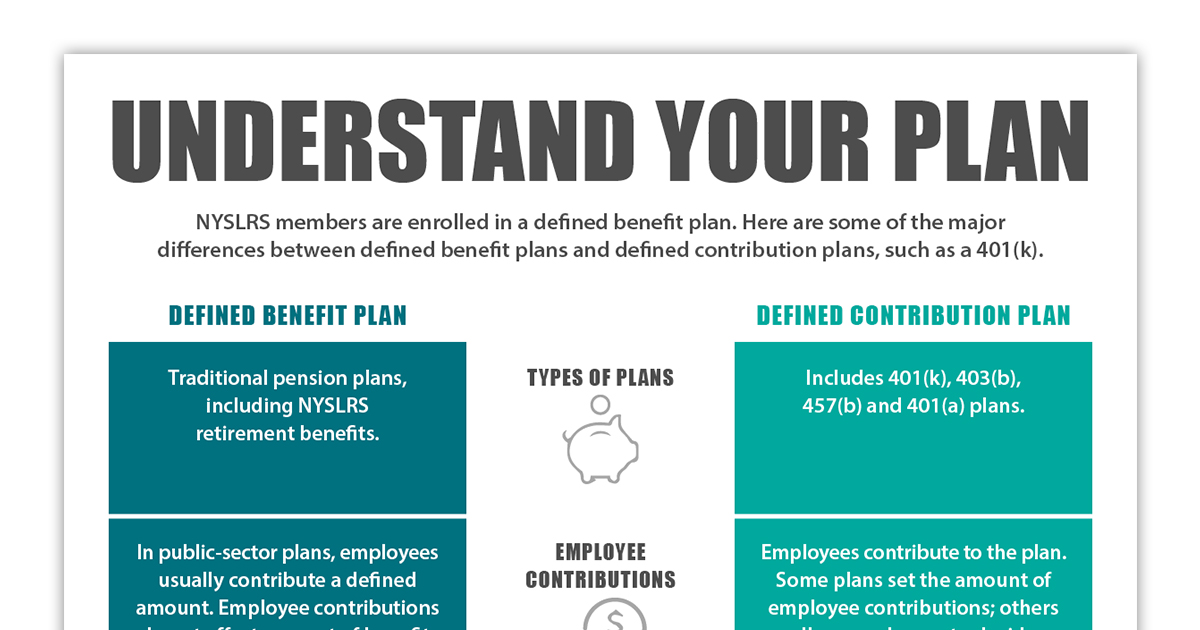

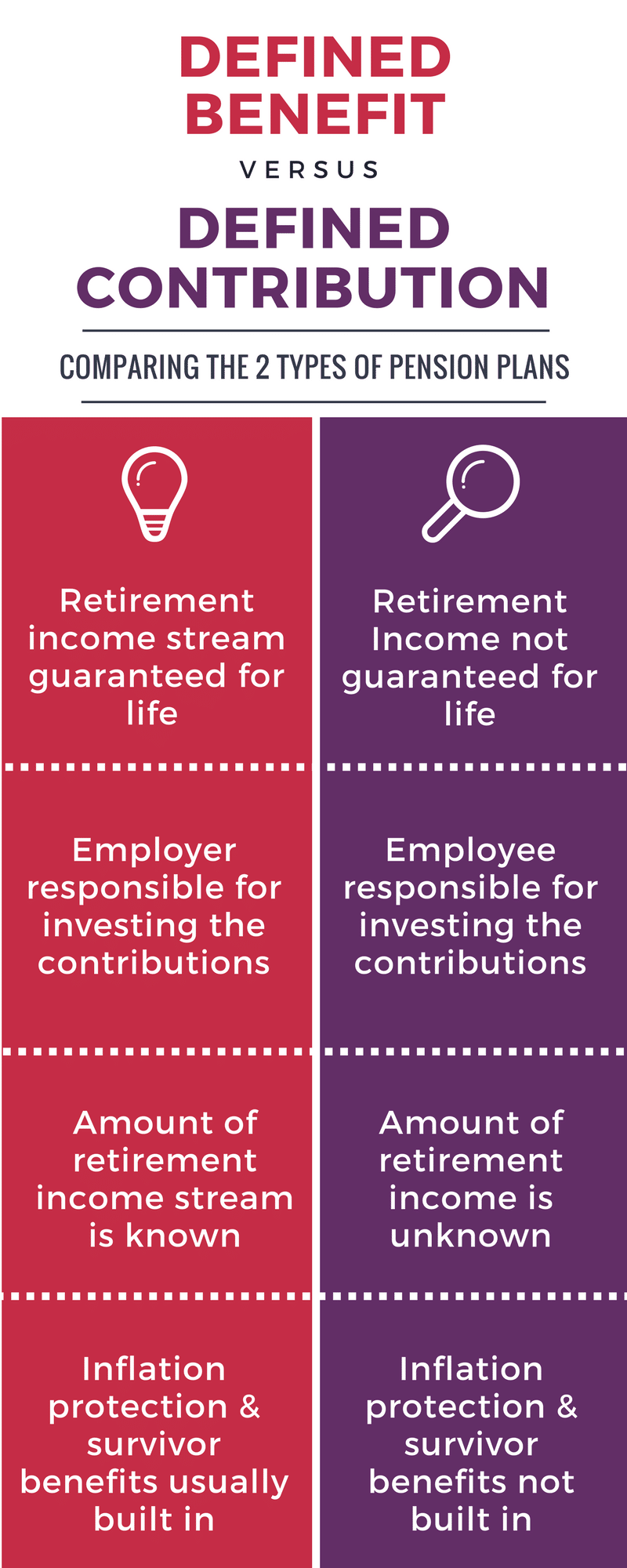

Defined Benefit Plan - Definition, Types, Example, Explanation Defined Benefit Plan vs Defined Contribution Plan. The main difference between a DBP and a Defined Contribution Plan lies in who bears the burden of contributing to retirement funds. In the former, it is undertaken by the employer, while in the latter, the employee and employer both contribute to the employee's retirement account. Moreover ... Defined Contribution Plan (Definition, Example) | How it ... a defined-contribution pension plan is a form of retirement plan where the employee or the employer and in some cases both of them make significant amount of contributions and that too on frequent basis with a motive to enable employees to save a decent amount of money for his retirement period and allow him to leave with utmost level of dignity …

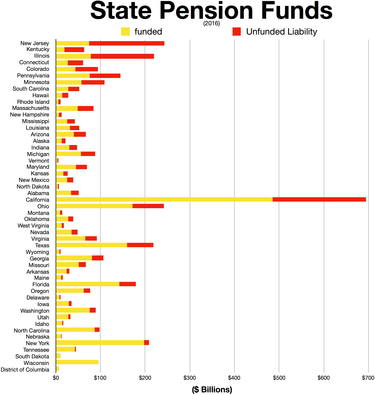

Defined contribution plans underfund workers' retirements ... Defined contribution plans underfund workers' retirements. Jan 17 2022, 3:57 PM. David Flemming's " Stopping the bleeding with pension reform" (VTDigger, Jan. 3) is an exercise in semantic ...

Defined contribution pension plan definition

What is a Defined Contribution Pension Plan? - Definition ... What Does Defined Contribution Pension Plan Mean? A defined contribution pension plan is a pension plan in which the employer makes a specific contribution per period of time, typically months or years. However, when the employee retires, the amount the employee can withdraw is not fixed. Instead, it depends on the success of the investments made. Defined contribution schemes - The Pensions Authority Defined contribution schemes. Defined contribution (DC) schemes are occupational pension schemes where your own contributions and your employer's contributions are both invested and the proceeds used to buy a pension and/or other benefits at retirement. The value of the ultimate benefits payable from the DC scheme depends on the amount of ... 4.72.8 Valuation of Assets in Defined Contribution Plans ... Apr 16, 2021 · If a contribution of property to a plan is covered by a prohibited transaction exemption, determine whether an employer exceeded the contribution or deduction limitations by contributing undervalued property to a qualified defined contribution plan. The IRC 4972 excise tax may apply.

Defined contribution pension plan definition. Defined Benefit Plan Rollover to an IRA ... - Saber Pension Jul 25, 2019 · Background: Defined Benefit Plan Rollover to an IRA. When a participant separates from service or an employer terminates their Defined Benefit Plan, the participant may be given the opportunity to receive a payout from the Plan. The form in which the benefit is paid out will depend on the Plan provisions. Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ... What Is a Defined Benefit Plan? - SmartAsset What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is an employer-provided retirement program that pays employees fixed income payments when they retire. Here's how these plans work. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email Loading Home Buying Calculators How Much House Can I Afford? Defined Contribution Pension schemes How defined contribution pension schemes work This is a type of pension where the amount you get when you retire depends on how much you put in and how much this money grows. Your pension pot is built up from your contributions and your employer's contributions (if applicable) plus investment returns and tax relief.

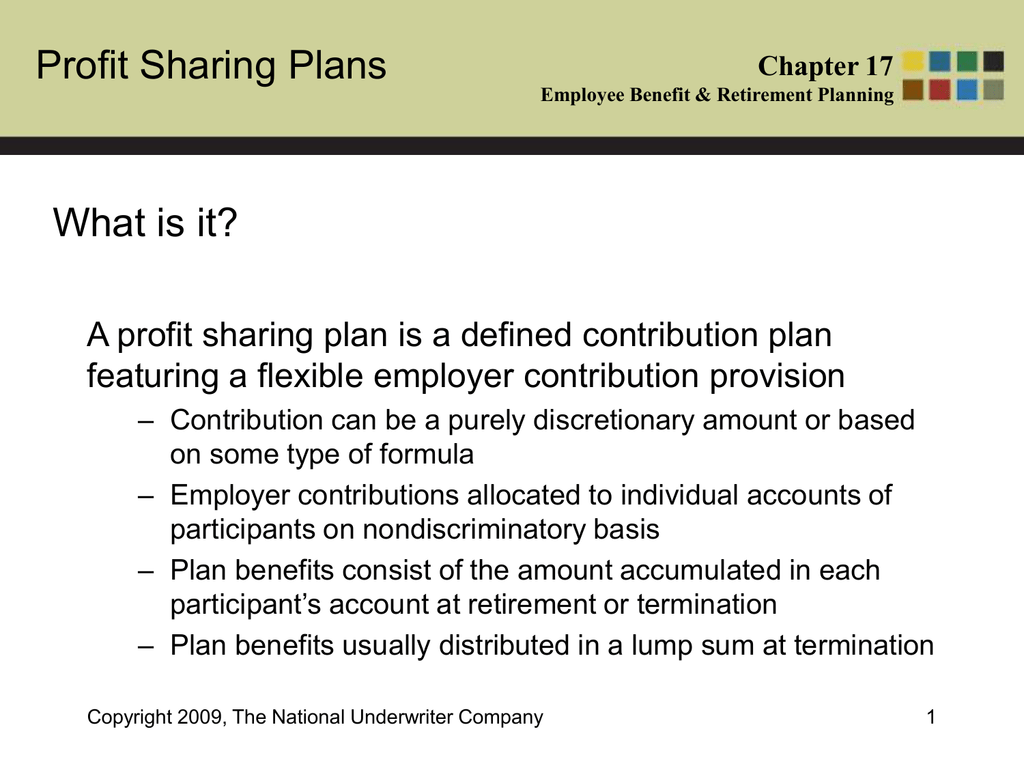

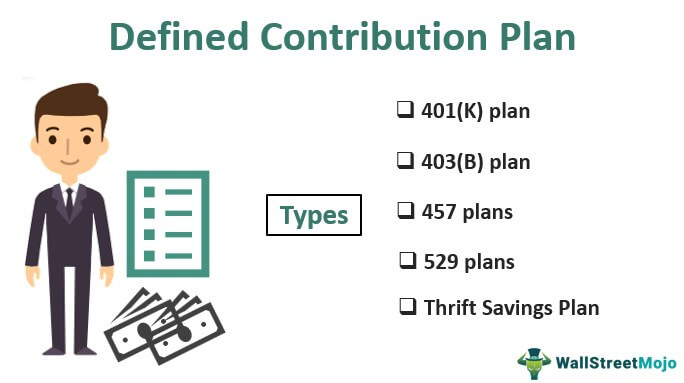

What is a defined contribution plan? | BlackRock A defined contribution plan is a common workplace retirement plan in which an employee contributes money and the employer typically makes a matching contribution. Two popular types of these plans are 401 (k) and 403 (b) plans. Defined contribution plans are the most widely used type of employer-sponsored benefit plans in the United States. Types of Retirement Plans | U.S. Department of Labor The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans.. A defined benefit plan promises a specified monthly benefit at retirement. The plan may state this promised benefit as an exact dollar amount, such as $100 per month at retirement. Defined contribution plan legal definition of Defined ... A defined benefit plan provides a set amount of benefits to a pensioner. Under a defined contribution plan, the employer places a certain amount of money in the employee's name into the pension fund and makes no promises concerning the level of pension benefits that the employee will receive upon retirement. Pension - Wikipedia A pension (/ ˈ p ɛ n ʃ ə n /, from Latin pensiō, "payment") is a fund into which a sum of money is added during an employee's employment years and from which payments are drawn to support the person's retirement from work in the form of periodic payments. A pension may be a "defined benefit plan", where a fixed sum is paid regularly to a person, or a "defined contribution …

What Are Defined Contribution Plans? Defined contribution plans are retirement savings plans that both employees and employers can contribute to. They are different from defined benefit plans like pensions because the employee must choose how the plan is invested, which determines what the end benefit will be. Defined contribution plans are popular among employers. What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions. Defined-contribution pension plan financial definition of ... defined-contribution pension plan Defined Contribution Plan A retirement plan in which the employee and/or employer contribute a set dollar amount each month. The benefits of a defined contribution plan are not set, and depend upon how well the contributions are invested before the pensioner starts to make withdrawals. PDF Defining participation in defined contribution pension plans pension participation for defined contribution plans should be consistent with the measure for defined benefit plans. Concepts that have been developed for defined benefit plans do not al-ways transfer directly to defined contribution plans. This article discusses the meaning of partici-pation in a defined contribution pension plan, and

Defined Contribution Pension Plan financial definition of ... A defined contribution pension plan, such as the 401(k) in the United States, allows company employees to set aside some of their salary for retirement with the company sometimes matching all or part of the amount. One in 10 Japanese firms favors 401(k) pension plan

Defined contribution plan - Wikipedia A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account.

Definitions | Internal Revenue Service Defined Contribution Plan is a retirement plan in which the employee and/or the employer contribute to the employee's individual account under the plan. The amount in the account at distribution includes the contributions and investment gains or losses, minus any investment and administrative fees.

Types of private pensions - GOV.UK defined contribution - a pension pot based on how much is paid in defined benefit - usually a workplace pension based on your salary and how long you've worked for your employer Defined...

Pension Plan vs. 401(k): Types, Pros & Cons - NerdWallet Jan 12, 2022 · A pension plan is a retirement plan that employers fund for employees. Here’s how a pension plan works, how it differs from a 401(k) and which one is better. ... A defined contribution plan such ...

PDF Defined Contribution Pensions: Plan Rules, Participant ... Over the last 20 years, defined-contribution pension plans have gradu-ally replaced defined benefit pension plans as the primary privately-sponsored vehicle to provide retirement income. At year-end 2000, employers sponsored over 325,000 401(k) plans with more than 42 mil-lion active participants and $1.8 trillion in assets.1

Defined-Benefit vs. Defined-Contribution Plan Differences As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan —provides a specified payment amount in retirement. A defined-contribution plan allows employees and...

Defined contribution plan | definition of Defined ... The majority of new qualified retirement plans established today by middle-sized companies are defined contribution plans. The Investment Company Institute Research Department recently published statistics showing that over 75% of middle-sized retirement plans were defined contribution plans.

Defined-Contribution Plan - Overview, Terms, Examples The defined-contribution plan is a type of pension fund to which an employee and/or an employer contribute based on terms agreed to by both parties. The employee decides how the pension funds are to be invested and also bears the risk of loss due to poor investments.

Defined-Contribution Plan Definition Apr 11, 2021 · The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date.

IRS Announces 2018 Pension Plan Limitations; 401(k ... Oct 19, 2017 · The limitation for defined contribution plans under Section 415(c)(1)(A) is increased in 2018 from $54,000 to $55,000. The Code provides that various other dollar amounts are to be adjusted at the same time and in the same manner as the dollar limitation of Section 415(b)(1)(A).

Defined contribution plan Definition & Meaning - Merriam ... Legal Definition of defined contribution plan : a pension plan in which the amount of the contributions made by the employer is fixed in advance and earnings are distributed proportionately Learn More About defined contribution plan Share defined contribution plan Dictionary Entries Near defined contribution plan defined benefit plan

Defined - definition of defined by The Free Dictionary de·fine (dĭ-fīn′) v. de·fined, de·fin·ing, de·fines v.tr. 1. a. To state the precise meaning of (a word or sense of a word, for example). b. To describe the nature or basic qualities of; explain: define the properties of a new drug; a study that defines people according to their median incomes. 2. a. To make clear the outline or form of ...

Defined Contribution Plan In a defined contribution plan, the employer and employee contribute a set or defined amount and the amount of pension income that the member receives upon retirement is determined by, among other things, the amount of contributions accumulated and the investment income earned.These contributions are often a fixed percentage of an employee's annual earnings and are deposited monthly in an ...

Defined Contribution Plan Summary Plan Description The Plan is a defined contribution plan under §401(a) of the Internal Revenue Code (the IRC). Future benefits from the Defined Contribution Plan (DC Plan) are comprised of contributions made to the DC Plan plus investment earnings. Employer contributions are subject to vesting. The designated Plan Administrator of the DC Plan is the Vice

PDF Defined contribution retirement plans: Who has them and ... Defined contribution plans often provide workers with incentives to save for retirement through employer matching contributions, thereby encouraging workers to make active choices in their retirement planning. These plans aim to put investment decisions into the hands of workers and they provide options for investing retirement funds.

Defined contribution plan - definition of Defined ... (redirected from Defined contribution plan) Also found in: Thesaurus, Medical, Legal, Financial, Acronyms, Encyclopedia. pen·sion 1 (pĕn′shən) n. A sum of money paid regularly as a retirement benefit or by way of patronage. tr.v.pen·sioned, pen·sion·ing, pen·sions 1. To grant a pension to. 2.

4.72.8 Valuation of Assets in Defined Contribution Plans ... Apr 16, 2021 · If a contribution of property to a plan is covered by a prohibited transaction exemption, determine whether an employer exceeded the contribution or deduction limitations by contributing undervalued property to a qualified defined contribution plan. The IRC 4972 excise tax may apply.

Defined contribution schemes - The Pensions Authority Defined contribution schemes. Defined contribution (DC) schemes are occupational pension schemes where your own contributions and your employer's contributions are both invested and the proceeds used to buy a pension and/or other benefits at retirement. The value of the ultimate benefits payable from the DC scheme depends on the amount of ...

What is a Defined Contribution Pension Plan? - Definition ... What Does Defined Contribution Pension Plan Mean? A defined contribution pension plan is a pension plan in which the employer makes a specific contribution per period of time, typically months or years. However, when the employee retires, the amount the employee can withdraw is not fixed. Instead, it depends on the success of the investments made.

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

/WorkRetirement-56eeac473df78ce5f8395f69.jpg)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

![PDF] Which plan to choose? The determinants of pension system ...](https://d3i71xaburhd42.cloudfront.net/938e2048a8a4e128378e8c333f6460aa54b8a639/12-Table1-1.png)

0 Response to "40 defined contribution pension plan definition"

Post a Comment